How has Government Revolutionized the FinTech Ecosystem?

The banking and financial sector landscape has undergone a remarkable transformation since the Global Financial Crisis (GFC) in 2008, owing to the FinTechs. FinTechs have contributed to the financial sector through multiple ways, such as better customer service, cost optimization, and financial inclusion. Moreover, FinTechs have played a significant role in segregating banking into core functions such as settlement payments, performing maturity transformation, risk-sharing, and capital allocation. However, the transformational changes brought about by FinTech should be monitored and assessed so that regulators can keep up with the fundamental entrepreneurial and technological flux.

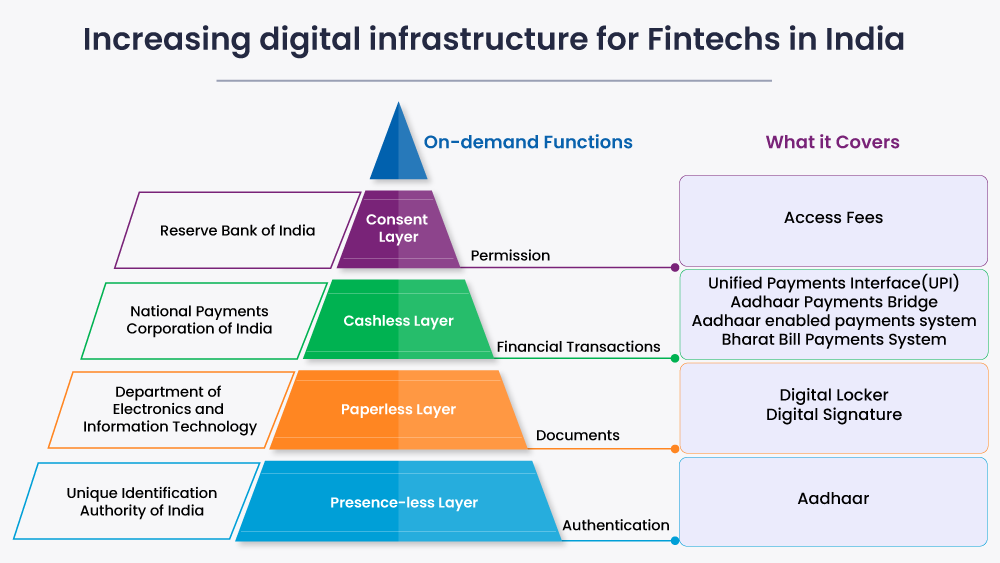

Consequently, regulators require being innovative, agile, and tech-savvy with their approach. They will have to shift their focus from entities to activities while expertly assessing the reliability and security of algorithms, which is indeed very complex. The FinTech sector in India has enormous potential as it is supported by an empowering strategy and digital infrastructure framework.

The Government plays a significant role in the success or failure of the FinTech sector that operates in a highly regulated financial industry. The Government of India, together with the regulators, has been supporting the objective of the Indian economy to create a robust FinTech ecosystem through funding and promotional initiatives. The Government has undertaken several initiatives for the Fintech ecosystem, some of which are listed below:

- Jan DhanYojana: is a financial inclusion program that aims at providing affordable and easy access to financial services such as remittances, bank accounts, credit, insurance, pensions, and a host of financial services applications. This has empowered FinTechs to build innovative technology products to creep into the large customer base in India.

- India Stack: is a societal initiative that is aimed at bringing the population of India to the Digital Age. It is a set of APIs that allow businesses, governments, and developers to leverage a unique digital Infrastructure to solve India’s hard-pressed issues towards paperless, presence less and cashless service delivery.

- Aadhar: This biometric identification system supports Aadhar Enabled Payment System and Aadhar Payment Bridge System:

- Aadhar Enabled Payment System allows people to perform financial transactions on a Micro-ATM by providing their Aadhaar number and authenticating it with the help of their iris scan/fingerprints.

- Aadhar Payment Bridge System simplifies bulk and repeated Government benefits and subsidy payments, aiding operations using the biometric authentication from Aadhaar-linked bank accounts.

- Unified Payments Interface: has been built as a scalable payments platform supporting digital payments in India.

- License for Payments Banks: This has improved the financial inclusion drive in the country by enabling the setting-up of payments banks while allowing access to remittance/ payments services.

- National Automated Clearing House System: This has been used for making bulk transactions effectively.

- Bharat Bill Payment System: The convenience of paying bills for consumers across different segments has been enhanced. It has been expanded to include billers (of various categories) who voluntarily raise recurrent bills as eligible applicants.

- Authentication Solutions: The development of various verification solutions such as digital KYC, digital signature, and video-based identification process of customers has created a robust system for FinTech companies while empowering customers to leverage technology-powered solutions.

Final Words:

Technology is bringing a significant shift in the world of finance. The Government of India has been making continuous efforts to make India a global FinTech hub by increasing investment inflows in the FinTech sector. This will provide powerful support for FinTechs to scale the business.